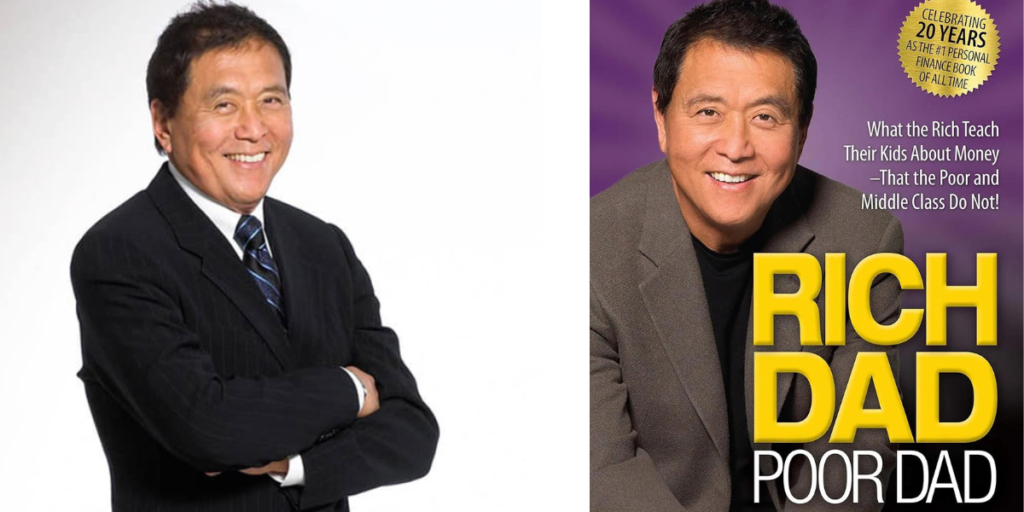

Robert Kiyosaki is a name synonymous with financial education and entrepreneurship. Best known for his bestselling book, Rich Dad Poor Dad, Kiyosaki has become a global icon in personal finance, investing, and financial literacy. His straightforward approach to money, investing, and wealth-building has empowered millions around the world to think differently about their finances. With multiple streams of income from books, investments, and business ventures, Kiyosaki’s net worth reflects the success he preaches.

In this article, we’ll take a deep dive into Robert Kiyosaki net worth, how he built his wealth, key financial principles he promotes, and the lessons we can learn from his journey. Additionally, we’ll examine his various income sources, investments, and how his ideas revolutionized personal finance.

Who is Robert Kiyosaki?

Before diving into the numbers, it’s important to understand who Robert Kiyosaki is. Born in Hilo, Hawaii, in 1947, Kiyosaki grew up in a middle-class family. His father, whom he refers to as “Poor Dad,” was a well-educated government official. On the other hand, his best friend’s father, referred to as “Rich Dad,” was a wealthy entrepreneur who dropped out of school but became a multi-millionaire.

Kiyosaki’s career began with a stint in the U.S. Marine Corps during the Vietnam War, after which he transitioned into business. His first major business success came from a company he co-founded that sold nylon Velcro wallets. However, his entrepreneurial journey wasn’t smooth, as he faced multiple failures before finding success as a financial educator and author.

Robert Kiyosaki Net Worth

As of 2024, Robert Kiyosaki’s estimated net worth is approximately $100 million. This fortune has been accumulated through various avenues, including book royalties, real estate investments, speaking engagements, and ownership of businesses.

Let’s break down the key components of his net worth:

1. Books and Royalties

Robert Kiyosaki has authored more than 26 books, with Rich Dad Poor Dad being his most famous work. Originally published in 1997, the book has sold over 32 million copies in more than 50 languages and continues to sell well globally. He earns substantial royalties from his books, which make up a significant portion of his income.

Kiyosaki also established a “Rich Dad” brand with a series of books that expand on the principles laid out in Rich Dad Poor Dad. These include titles like Cashflow Quadrant, Retire Young Retire Rich, and Rich Dad’s Guide to Investing.

2. Real Estate Investments

One of the key themes in Rich Dad Poor Dad is the importance of real estate as an income-generating asset. Kiyosaki has practiced what he preaches, investing heavily in real estate throughout his life. His real estate portfolio includes residential, commercial, and industrial properties that provide ongoing cash flow.

Kiyosaki often highlights that real estate is one of the primary ways he built his wealth, especially through leveraging other people’s money (OPM) to finance his investments.

3. Business Ventures

Kiyosaki is involved in several business ventures, including the Rich Dad Company, which offers financial education programs, seminars, and online courses. The company has grown into a multi-million-dollar enterprise, helping individuals worldwide achieve financial freedom.

He also co-founded Cashflow Technologies Inc., a company that markets educational products such as the CASHFLOW board game, designed to teach people how to manage money and invest wisely.

4. Public Speaking and Seminars

As a renowned financial educator, Kiyosaki is a highly sought-after speaker at seminars and conferences. He has delivered keynote addresses at financial events and offers paid workshops that teach individuals how to manage money, invest in real estate, and build businesses. These speaking engagements contribute significantly to his overall income.

5. Other Investments

Kiyosaki has been vocal about his investments in other asset classes like stocks, precious metals (particularly gold and silver), and cryptocurrencies. He is known for diversifying his portfolio and has even stated his preference for gold and Bitcoin as a hedge against inflation and economic instability.

How Robert Kiyosaki Built His Wealth

Kiyosaki’s journey to financial success wasn’t a straight path. After several failed businesses in the 1970s and 1980s, he realized the importance of financial literacy. His philosophy revolves around the following core principles:

- Mindset Over Money: Kiyosaki emphasizes that wealth-building is more about the mindset than the amount of money you start with. He stresses financial education as the key to escaping the rat race.

- Assets vs. Liabilities: One of the most powerful lessons in Rich Dad Poor Dad is the distinction between assets and liabilities. According to Kiyosaki, assets are anything that puts money into your pocket (like real estate or stocks), while liabilities take money out (such as cars or luxury items).

- Cash Flow is King: Kiyosaki focuses on building passive income through cash-flowing assets, like rental properties, instead of relying on a paycheck.

- Leverage and Debt: While most people view debt as dangerous, Kiyosaki argues that there is “good debt” and “bad debt.” He advocates using good debt (like loans for investments) to acquire cash-flowing assets.

Breakdown of Robert Kiyosaki’s Income Sources

| Income Source | Description | Percentage of Net Worth |

|---|---|---|

| Book Royalties | Income from the sales of his bestselling books, including Rich Dad Poor Dad | 30% |

| Real Estate Investments | Residential, commercial, and industrial real estate properties | 40% |

| Business Ventures | The Rich Dad Company, Cashflow Technologies, and other businesses | 15% |

| Public Speaking & Seminars | Paid keynote addresses, seminars, and workshops | 10% |

| Other Investments | Stocks, precious metals, and cryptocurrencies | 5% |

Lessons to Learn from Robert Kiyosaki

Robert Kiyosaki’s approach to wealth-building offers valuable lessons for anyone looking to improve their financial situation:

- Invest in Yourself First: Kiyosaki places a huge emphasis on financial education. Before investing in real estate or stocks, he advises that individuals invest in their own knowledge and understanding of money.

- Diversify Your Income: Don’t rely on just one stream of income, like a paycheck. Kiyosaki stresses the importance of multiple income streams, especially those that are passive, like rental properties or investments.

- Understand the Difference Between Assets and Liabilities: Knowing the difference can significantly affect your financial future. Focus on acquiring assets that will put money into your pocket, not liabilities that drain your finances.

- Embrace Calculated Risk: Kiyosaki believes that taking risks is essential to achieving financial success. He advocates for taking calculated risks, especially in real estate, to grow wealth.

- Think Long-Term: Kiyosaki is a proponent of long-term wealth-building. He advises people to invest in assets that will generate income for years to come rather than chasing short-term gains.

Conclusion

Robert Kiyosaki’s journey from a struggling entrepreneur to a multi-millionaire and best-selling author is both inspiring and instructive. His emphasis on financial education, acquiring cash-flowing assets, and leveraging debt has resonated with millions of people globally. As of 2024, with a net worth of $100 million, Kiyosaki continues to be a leading voice in personal finance and wealth-building.

For those looking to improve their financial situation, Kiyosaki’s principles serve as a valuable guide. Whether it’s through reading Rich Dad Poor Dad, investing in real estate, or building multiple streams of income, the lessons from Robert Kiyosaki’s life can help anyone take control of their financial future.

Read More Blogs